carried interest tax proposal

The lawmakers provided this example. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried.

How Do Employers Set Up An Ichra Health Insurance Plans Types Of Health Insurance Affordable Health Insurance

Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

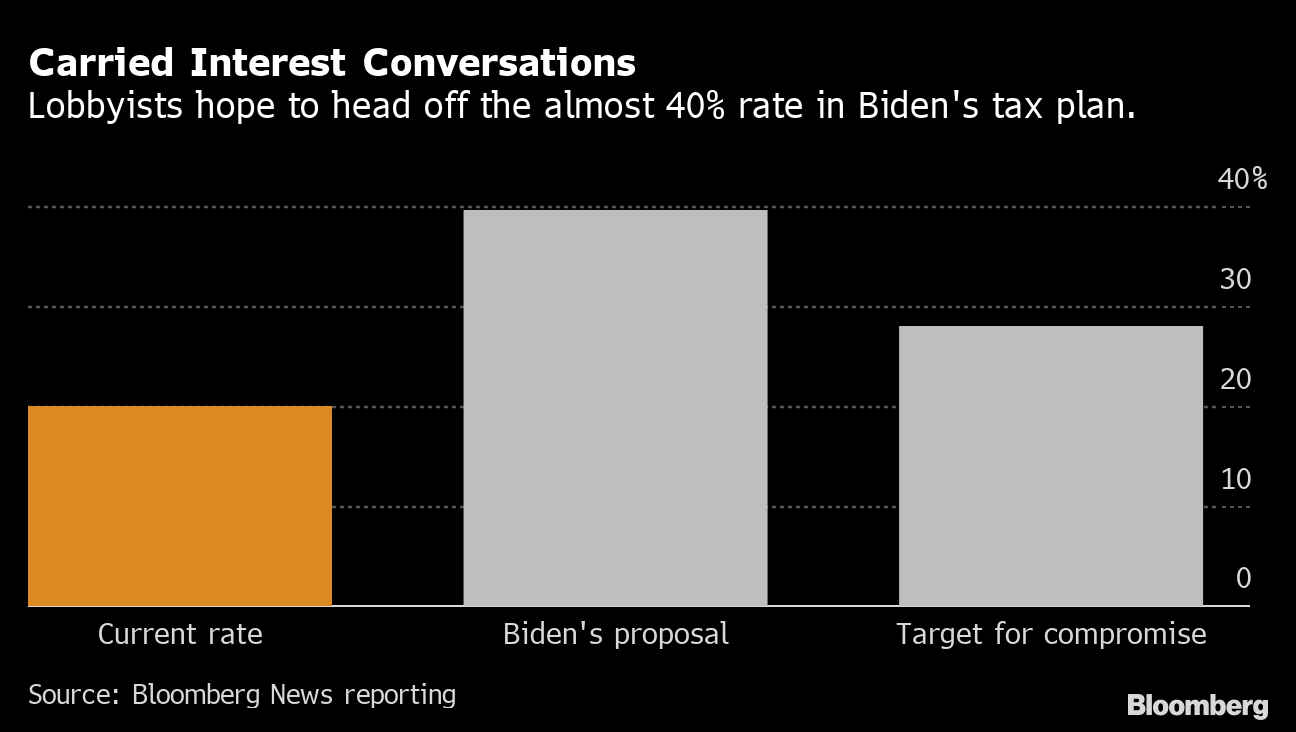

. The proposal would create a new 15 percent minimum tax on big corporations. Beyond issues of fairness taxing carried interest at higher rates is a poor proposal on its own merits. Va initially proposed curtailing the tax break for carried interest.

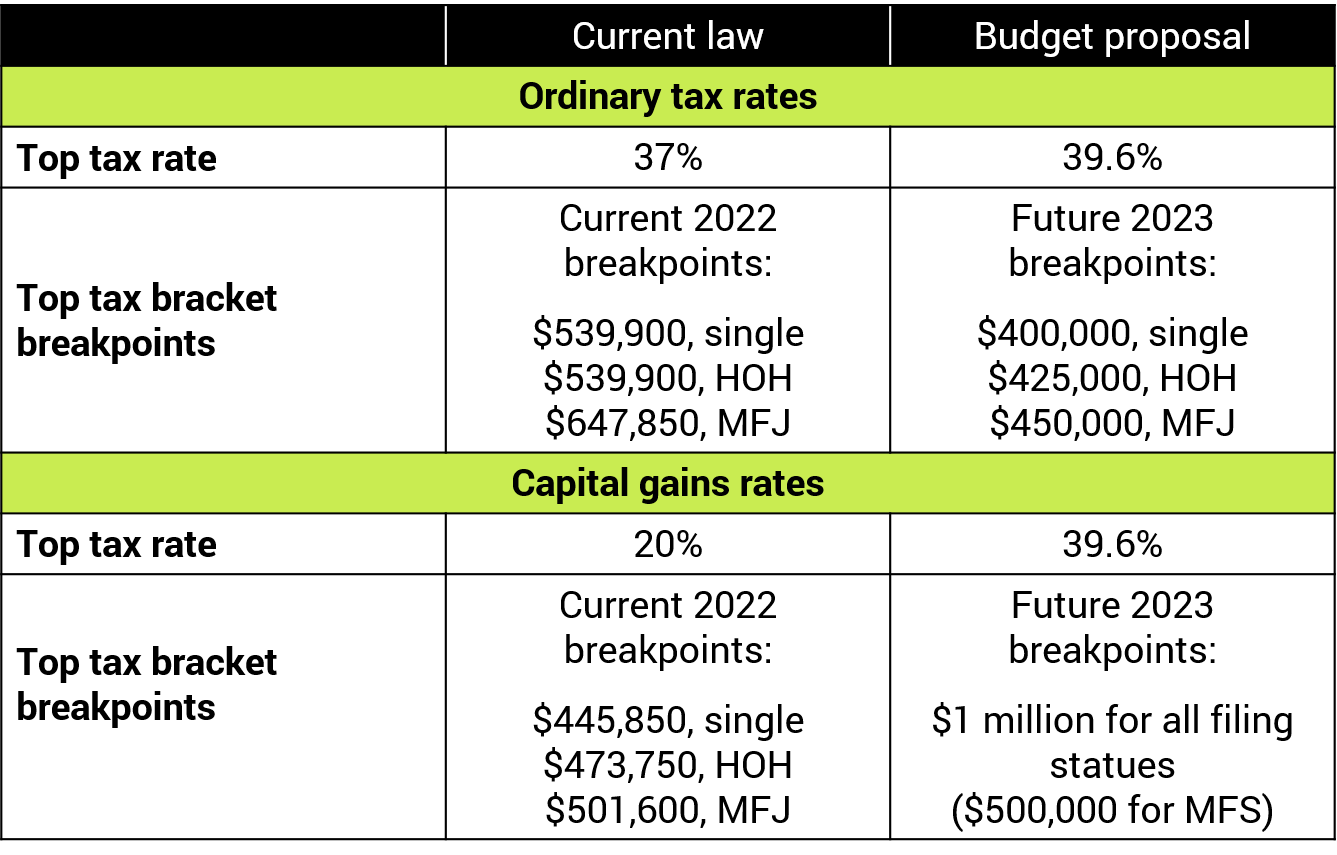

The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022. The top individual rate would be 396. NEW MINIMUM TAX ON BIG BIZ.

If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the. The Biden administration fact sheet misleadingly implies that a carried interest tax would only hit hedge funds while other proponents of the tax hike portray carried interest. Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees.

The current tax treatment of. Present law The Tax Cuts and Jobs Act added Section. Carried interest is a share of profits earned by general partners of private equity venture capital and hedge funds.

Carried interest is due to general partners based. While the committee stopped short of taxing all carried interest as ordinary income. The proposal to single out carried interest as the sole tax increase on high earners is rooted in Democrats longstanding disdain for a tax preference that lets fund.

Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. The proposals would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized. At most private equity firms and.

Carried interest is very generally a share of the profits in a partnership paid to its manager. Rather than be subject to the normal individual income tax rate 37 for the highest bracket of earners carried interest so long as it is held for at least three years is. Carried interest makes more sense being taxed as a capital gain.

The carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on energy. The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration could create Securities and Exchange. Details are still sketchy but its aimed at companies that.

At most private equity firms and hedge. To do that he said he would tax long-term capital gains at the ordinary top income tax rate essentially wiping away the special treatment of carried interest. The proposed carried-interest change would include some exceptions retaining the three-year holding period for real property trades.

15 hours agoA deal brokered by Senate Majority Leader Chuck Schumer D-NY and Sen.

Simple Purchase Agreement Template Beautiful 37 Simple Purchase Agreement Templates Real Estate Business Stcharleschill Template

Format Of Partnership Deed As Per Income Tax Act Partnership Deed Taxact Income Tax Partnership

Explore Our Example Of Written Quotation Template Estimate Template Quote Template Event Planning Quotes

Goods And Services Tax Gst Is A Huge Reform For Indirect Taxation In India The Likes Of Which T Goods And Service Tax Accounting Services Goods And Services

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Building Contractor Appointment Letter Templates At Allbusinesstemplates Com

Carried Interest In Private Equity Calculations Top Examples Accounting

The New York Times Front Page Saturday May 13 Announcing The Executions Of John Mcdermott Sean Mac Diarmada And Front Page News Her Book Documentaries

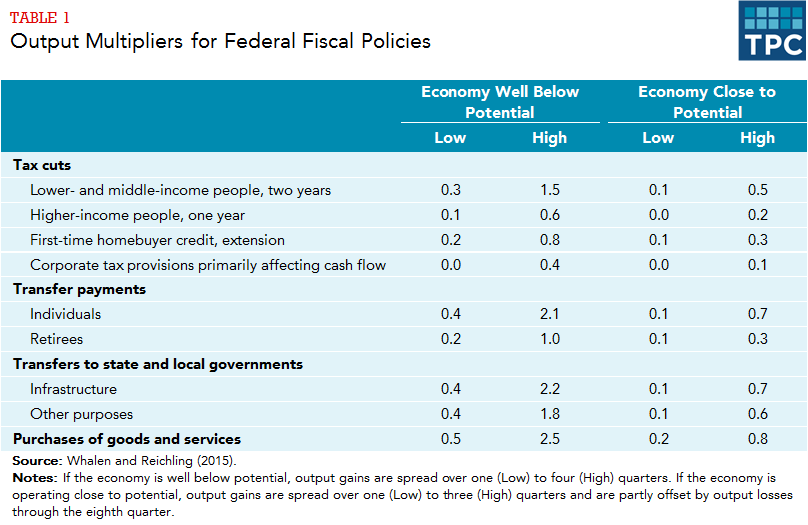

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Fund Managers Thoughts On The Carried Interest Tax Loophole

U S Online Spending Set To Rise 14 8 Percent In 2018 Holiday Season

Semi Truck Lease Purchase Agreement Form My Templates

Tax On Resp Withdrawal Lower The Tax Maximize The Benefit Manulife Investment Management

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Sample Partnership Agreement Template Template Forms 2022

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg